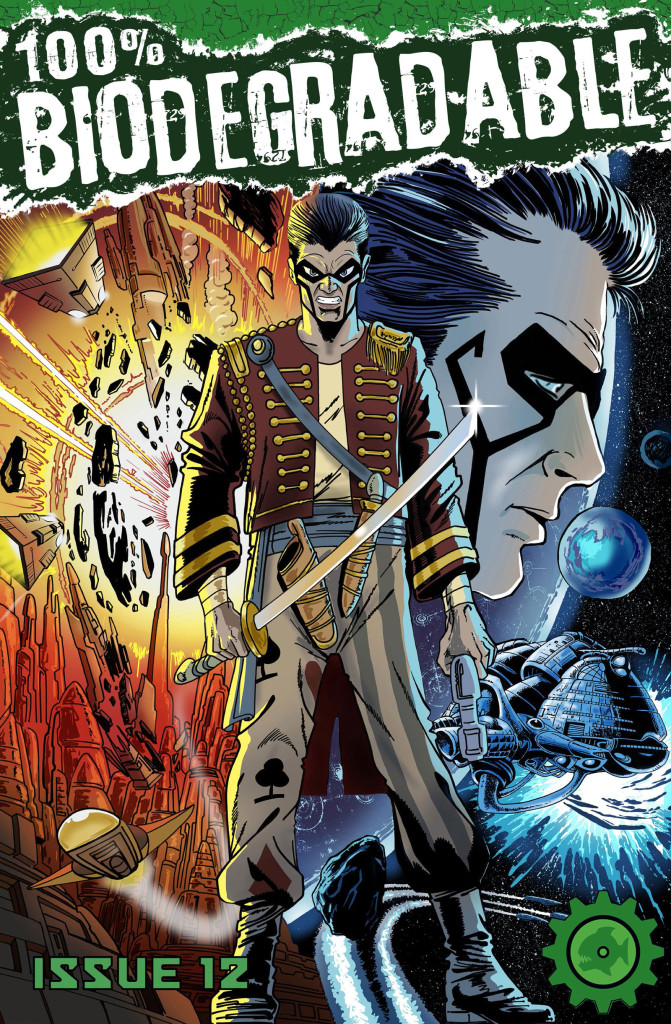

Digital comic Biodegradable – just one title that’s affected by VATMOSS rules. Art by Bill Storie, inked by Brett Burbridge

Anyone remember the VATMOSS debacle which is still costing small business time and money – including comic creators selling digital editions? The debacle that put some small electronic publishers out of business?

We reported on it here last year – along with concerns that the rules would be extended to physical goods, which, thankfully, has been delayed… for now.

Well, sadly, it doesn’t look like the “VATMESS” will go away – even if the UK votes to leave the EU on 23rd June 2016.

VATMOSS, which stands for VAT Mini One Stop Shop, refers to the EU digital VAT rules introduced at the beginning of the 2015 which requires that VAT be charged on digitally delivered services where the customer is based, rather than the location of the business.

As the Daily Telegraph reported last year, it was created to prevent big businesses that have established headquarters in lower-VAT regimes from profiting unfairly, but its inventors failed to anticipate the impact on small companies.

Suddenly, UK-based micro-businesses selling digital products such as e-books or online tuition found themselves embroiled in a fiscal fiasco.

Although platforms selling comics such as Amazon Kindle, ComiXology and DriveThru deal with the VAT issues on behalf of independent comic creators, and other concessions were agreed after it was introduced, the “VATMESS” still complicates the selling of PDFs and other digital downloads for those preferring an independent option.

Since the rules were introduced to the dismay of small business, despite a long gestation period, discussions on the issue have continued, largely co-ordinated by EUVATaction, and there have been some changes to the rules in the UK as a result, which have met with mixed response. Recently, campaigner Clare Josa posted a post debunking some of the myths surrounding what will happen to EU Digital VAT if we leave the EU.

Over on the Facebook VATMOSS discussion group, and, among others, former lecturer and software engineer Bob Lang has also noted that leaving the EU will not absolve companies from having to pay VAT in European countries, but it is likely to make the process even more complex than it is now.

“If we’re really really lucky, HM Revenue & Customs may continue to operate the one-stop shop as now, and will continue to act as intermediary,” he opines. “However, this is by no mean certain, and if it doesn’t happen then companies will have to register with the MOSS in another country, with Eire being the obvious choice as they speak English.

“Another problem with leaving the EU is that all progress made so far in Europe highlighting the flaws in the system will probably be lost, and we won’t have our MEPs to call on either. So please don’t vote Brexit because it will make life simpler, it won’t.

“Of course, companies will have the option to ignore EU VAT altogether, which will make them technical criminals,” he acknowledges. “Even this might seem to be a reasonable option, but since UK passports will now be checked at airports, I’d be a little concerned that you might be arrested boarding the flight home.”

He was derisive of a suggestion that the UK could leave the EU Digital VAT System if it left the EU, saying a Brexit would make on difference.

“We can change our rules, but we don’t have a problem with our rules because we’re already (most of us) below the VAT threshold,” he explains. “The problem is that to sell legally into the EU we have to follow their rules (whether we like it or not), and us leaving isn’t going to make them change.

“As others have said, if we leave the EU then the UK HMRC will dismantle its MOSS, and once that happens our options are to register with Eire’s MOSS, or not sell into the EU, or to sell without paying VAT – essentially trading illegally.

“If we trade illegally then we don’t know what the future consequences might be; there may be no consequences, or you may find yourself arrested for unpaid Spanish VAT when you visit the Costa Brava on holiday.”

Food for thought in the run up to the referendum vote – and one of many issues that have been made overly-complex for most of us, whatever way we plan to vote.

• EU VAT Action Campaign website: http://euvataction.org | EUVAT Action on Facebook

The discussion group is a positive and constructive space for business owners to learn about the new law, and find ways to keep trading legally; whilst keeping up to date with the campaign, and supporting and contributing to it

• If you think VATMOSS affects you as a comic creator, then check this “Key Facts” guide to the legislation for detailed information on its impact

• What Will Happen To EU Digital VAT If We Leave The EU? 10 Popular Myths Debunked by Clare Josa

• Register for a VATMOSS shop with HMRC

What’s Happening With VATMOSS in 2016?

The EUVATAction Group reports the current status as follows

VATMOSS did not come into force for physical goods on 1st January 2016, but legislation will be proposed next year that will include proposals for:

- The removal of the Distance Selling Thresholds

- The removal of Small Value Consignment Relief

- The extension of VATMOSS to physical goods, so that you don’t have to register for VAT in 27 countries just to sell a widget or three

- A threshold for this year’s Digital VAT changes, below which your home country VAT rules will apply

- A threshold above that level with a simplified version of the rules for Digital VAT

If you have strong views on these measures, please start talking to your MPs / MEPs / Tax Authority, so that they can make sure the legislation is well-drafted. It will still take a couple of years to negotiate and implement, so we’re at least two – three years away, but “we have seen the mess that was accidentally made with digital VAT,” say the EUVATAction Group. “You need to be acting on this one already.

“And if you’re a member of an industry representative body or a regulatory body, please get them involved, too. Although your voice counts, they will have fast-track access to the decision-makers and it’s often the best way to make your voice heard.”

Interim Threshold For Digital VAT

This is urgently needed. Whilst getting the threshold legislation proposed is a huge achievement, any permanent threshold is unlikely to come into effect before 2019 / 2020. So you need to keep hassling your MPs & MEPs to tell your Finance Minister to lobby ECOFIN to bring in an interim threshold, while these laws are passed. (They will understand what all of that means! If you’re not sure, here’s a video that explains it, published last October).

The EUVAT Action Group are asking for €20,000 of cross-border, digital sales as the first threshold, and €100,000 of cross-border digital sales for the ‘soft landing’ zone.

The Good News

The European Commission and HM Treasury (UK) have confirmed that the selling of digital services with a strong human intervention component will remain under domestic Place Of Supply rules. So live webinars, courses with integral live components and other high-human-intervention components will continue to be liable for VAT based on the business’s location, rather than the customer’s. This is great news for those selling those products. “However,” say EU VAT Action, “we need to keep in touch with our government representatives to make sure this doesn’t get lost during the negotiations.”

[divider]

Just want to buy the brilliant-looking comic that heads up this item?

• Buy 100% Biodegradable on ComiXology

• You can grab 100% Biodegradable Issue 12 on Drivethru here

• Grab 100% Biodegradable Issue 12 from Comicsy here

More Good Stuff from the 100% Biodegradable team

• You can currently get issues 1-11 of 100% Biodegradable for just £5, if you support Jimmy Furlong’s ‘Sh*t Flingers Bestiary’ Kickstarter

• Make use of Ken Reynolds‘ (assistant editor of 100% Bioddegradable, who letters the majority of the strips) mighty fine lettering service by supporting his ‘Cognition’ Kickstarter

• If you like Bill Storie and Brett Burbridge’s “Death Duty” cover for the latest 100% Biodegradable, you can buy it as a poster here

The founder of downthetubes, which he established in 1998. John works as a comics and magazine editor, writer, and on promotional work for the Lakes International Comic Art Festival. He is currently editor of Star Trek Explorer, published by Titan – his third tour of duty on the title originally titled Star Trek Magazine.

Working in British comics publishing since the 1980s, his credits include editor of titles such as Doctor Who Magazine, Babylon 5 Magazine, and more. He also edited the comics anthology STRIP Magazine and edited several audio comics for ROK Comics. He has also edited several comic collections, including volumes of “Charley’s War” and “Dan Dare”.

He’s the writer of “Pilgrim: Secrets and Lies” for B7 Comics; “Crucible”, a creator-owned project with 2000AD artist Smuzz; and “Death Duty” and “Skow Dogs” with Dave Hailwood.

Categories: British Comics, Creating Comics, Digital Comics, Digital Media, downthetubes Comics News, downthetubes News

Envision Entertainment soft launches new digital comics app, “Fable”, at MCM London this weekend

Envision Entertainment soft launches new digital comics app, “Fable”, at MCM London this weekend  Beano collaborates with Guide Dogs on first audio comic strip created especially for people with a vision impairment

Beano collaborates with Guide Dogs on first audio comic strip created especially for people with a vision impairment  VR Comics Spotlight: “Angel Eyes” features work of a great team of British comics talent

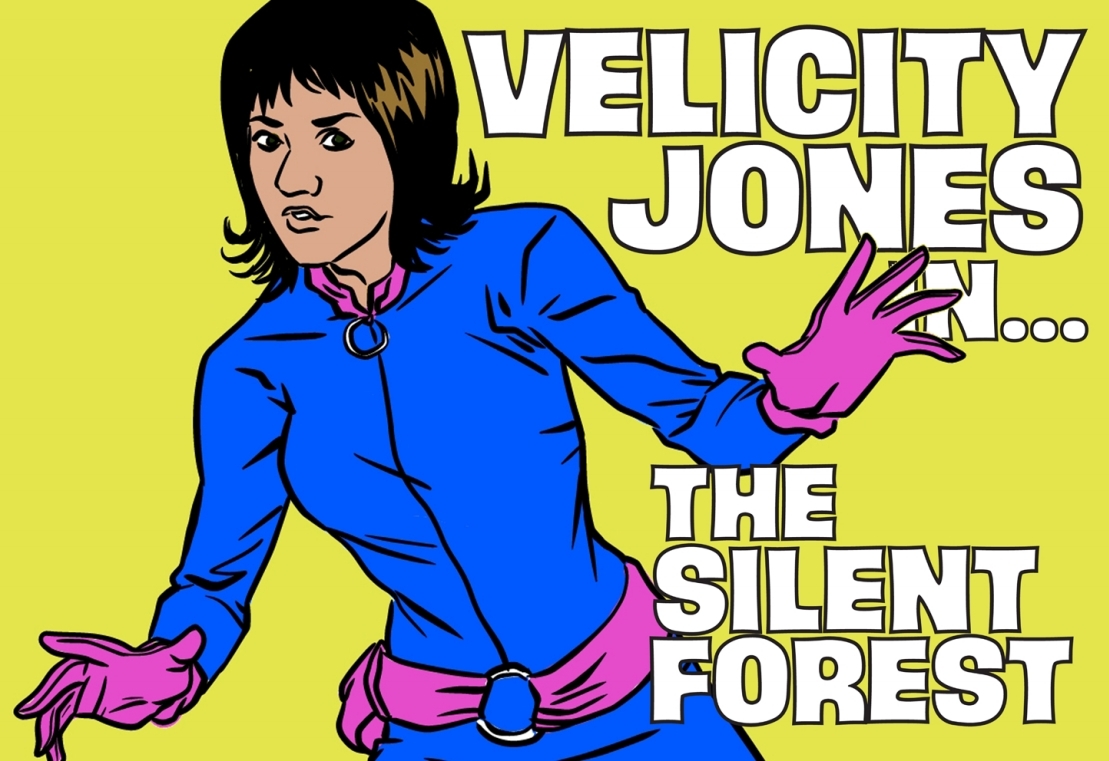

VR Comics Spotlight: “Angel Eyes” features work of a great team of British comics talent  Velicity Jones back in Aces Weekly!

Velicity Jones back in Aces Weekly!